The Three-Category Budget: Budgeting for Beginners

Control your spending in three problem categories every month!

If starting a budget seems like a daunting task, this easy budgeting method can help. The three-category budget identifies trouble areas in your financial habits and focuses on limiting spending in those categories. Many don’t realize just how much they spend monthly at restaurants or on clothing; this beginner-friendly budget shows you these worrisome categories so you don’t have to fret about overhauling your entire financial system. Learn how to cut back on all of your flexible expenses so you can focus on savings and debt repayment. The beauty of this budget is that once you’ve limited your spending in your first set of categories, you can easily target additional categories until your monthly expenditures are where you’d like them to be.

Budget Big Idea

Most people overspend in a few categories that can easily be cut down with conscious effort.

How to Start a Three-Category Budget

Implementing the three-category budget could not be simpler. The first task is to track your spending for at least one month (but preferably 2-3) so you can start to see spending patterns. If you have receipts or bank statements, you can even look back on past months’ expenses.

Once you have a typical month's expenses, categorize them into like groupings. The important part of this step is to create reasonable categories that accurately represent your spending habits. You can be as general or specific as you need to be to demonstrate your disbursements.

When you have your categories outlined, see how much you are spending in each category; the results may surprise you! Pick three trouble areas and set reasonable goals on how much your ideal expenses would be. Think about your goals every time you plan to make a purchase in that category. Focus your budgeting efforts on curbing your spending in those categories for a few months or until you meet your goals.

You can adjust this category to meet your budgeting needs. You might find that you only have one trouble area that needs attention or ten smaller areas that are all worrisome. Focus on as many or as few as you can handle at any given time, but remember that this budgeting solution is designed to be a low-stress way to cut expenses.

Potential Spending Categories

If you don’t know how to organize your spending, here are a few suggested categories with which many beginner budgeters have trouble.

- Restaurants

- Groceries

- Entertainment

- Clothing

- Beauty Products

- Fitness

- Transportation

- Decor/Furniture

- Cable

- Subscription Services (Netflix, Amazon Prime, etc.)

Budgeting Tips

- This budget is ideal for those who can easily cut spending on various flexible expenses, not essential expenses like rent or utilities.

- Make realistic goals for yourself; completely cutting your entertainment costs is not sustainable for savings as you'll likely splurge every few months and not be prepared for it.

- The budget works best when you consistently curb your spending a little bit each month for extra savings, not when you completely cut a category out of your life for one or two months.

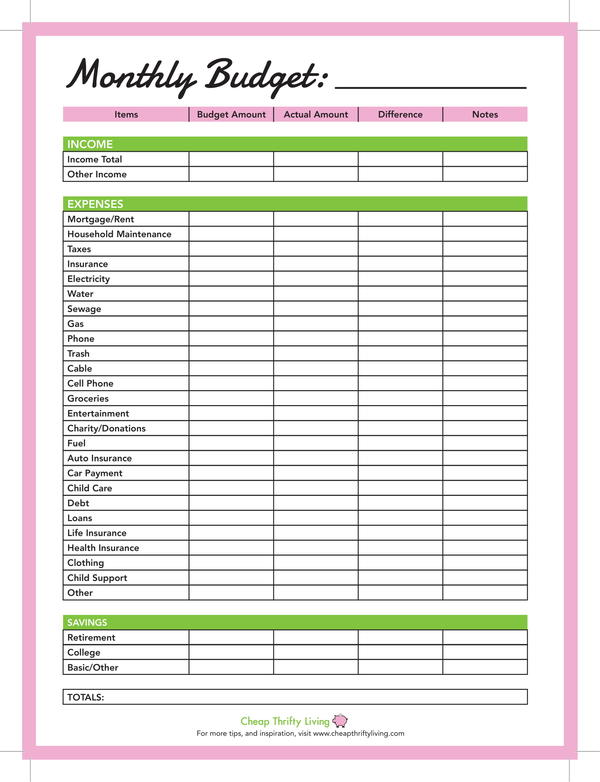

Free Budgeting Worksheet

In which categories could you curb your spending?