The 50/30/20 Budget: Budgeting for Beginners

This personal budgeting method will ensure you save money each month!

When starting a budget, you may feel overwhelmed by where you should focus your efforts. One of the easiest budgeting solutions is the 50/30/20 budget, which breaks your monthly income into three categories: essential expenses, non-essential expenses, and savings. By breaking up your earnings into these categories, you won’t have to wonder how much you can spend on entertainment and you’ll ensure that you put a good portion back for savings or debt repayment. There’s also a simpler variation called the 80/20 budget which just separates saving from spending which focuses on incorporating saving money each month rather than where the 80% is allocated.

Budget Big Idea

You should be saving a good portion of your monthly income for emergencies and large expenses.

How to Start a 50/30/20 Budget

The 50/30/20 budget separates your monthly earnings into three simple categories. It is very simple to implement this budgeting rule of thumb into your monthly finances.

50% should be spent on essential living expenses like rent/mortgage, groceries, transportation, and utilities. These expenses should include everything that is a monthly necessity. Overlooked essentials include minimum monthly payments for debt and insurance premiums.

No more than 30% should be spent on non-essential expenses. These costs include anything that goes beyond necessities for living and can consist of entertainment, going out to eat, gym memberships, and subscription services. While you have money to spend here, it is important to stay under the 30% threshold.

A minimum of 20% should be saved each month. You can save money for large expenses or emergency funds or use this money to pay off existing debt in a more timely manner. This 20% also includes the money that you put into your retirement account each paycheck.

When the 50/30/20 Budget Doesn't Work

This isn’t a one-size-fits-all budget. While this budgeting method is a good general rule of thumb, the percentages may not work for every income level or cost of living. If you live in a low-cost area, 50% on living expenses can seem like overkill. Conversely, if you live in a large city, it may impossible to only spend 50% of your income on your living costs. The important aspect of this budget is to save a good portion of your monthly earnings.

Budgeting Tips

When beginning any new budget, it's always a good idea to monitor your spending for a few months to see the current state of your finances. You can either look back at receipts and bank statements or monitor at the beginning of the next month to track your typical expenditures. When you have a clear sense of your present spending habits, it's easier to implement a budget as you know exactly what areas you can target to increase your savings. Once you have a clear picture of your finances, find ways to curb your spending to fit the 50/30/20 percentages or whichever percentages work best for your cost of living.

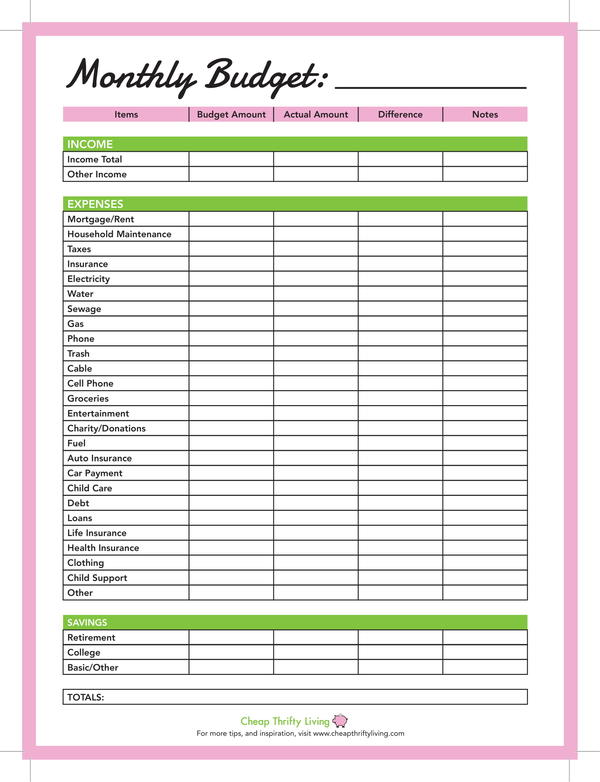

Free Budgeting Worksheet

Anyone new to budgeting needs a starting guide to tracking your monthly spending. This free, printable worksheet will help you keep track of your expenses every month!

How do you divvy up your budget?